On the PAYD Administration main screen, click the  (Configuration) icon.

(Configuration) icon.

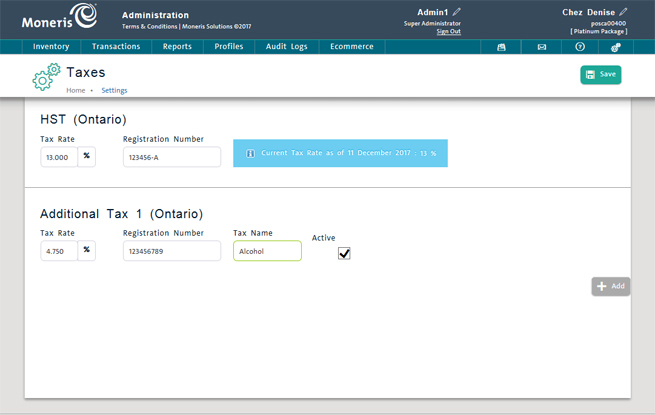

Use the Taxes screen view to configure the federal and/or provincial sales tax rates. You can edit tax rates as needed as well as enter tax registration numbers.

NOTE: You are responsible for determining applicable sales tax rates on goods and services sold within and outside Canada. Sales tax rates may change from time to time, and it is your responsibility to update the rate information on this screen as needed.

On the PAYD Administration main screen, click the  (Configuration) icon.

(Configuration) icon.

The Configuration menu appears.

On the Configuration menu, click Tax.

The Taxes screen displays the applicable federal and provincial tax rates with the following information:

Tax Rate - The applicable tax rate (editable).

Registration Number - The tax registration number assigned to you by the applicable taxing authority (editable).

In the appropriate Tax Rate textbox, enter the new tax rate.

Click the Save button at the top of the screen.

In the appropriate Registration Number textbox, enter the tax registration number assigned to you by the applicable taxing authority.

Click the Save button at the top of the screen.

You can now configure up to three additional taxes in PAYD Pro Plus. If your business needs to track and report additional taxes other than HST, GST or PST (e.g., an alcohol, tobacco, lodging, or fuel tax). These taxes can then be applied to individual products in the product’s profile.

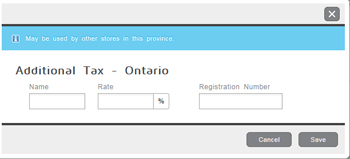

Click the Add button on the right side of the screen.

A popup appears.

Enter a tax name in the Name field.

Enter a tax rate in the Rate field.

Enter a tax registration number in the Registration Number field.

Click the Save button in the bottom right corner of the popup.

Repeat steps 1 - 6 as necessary.